Our flagship mine, LaRonde, continues to be a consistent, reliable, world-class mine, maintaining its solid operating performance again in 2009. The mill processed an average of 6,975 tonnes of ore per day versus 7,210 tonnes per day in 2008, a lower rate due to two planned maintenance shutdowns.

LaRonde’s total cash costs per ounce were $103 on payable gold production of 203,494 ounces, placing it among the lowest cash cost gold mines in the industry. This compares to total cash costs per ounce of $106 on gold production of 216,208 ounces in 2008, as lower gold production was more than offset by stronger byproduct metals prices.

Good cost control continued to be a hallmark of LaRonde. Minesite costs per tonne were approximately C$72, roughly 7% higher than in 2008 due to cost pressures in the industry for inputs such as labour and chemical reagents, but in line with expectations.

In 2010, gold production at LaRonde is expected to decrease to approximately 180,000 ounces as gold grades decline until late 2011 when the deeper, richer ore of the LaRonde extension is accessed. From 2011 to 2014, annual gold production of approximately 248,000 ounces is expected, reflecting the higher gold grades. Total cash costs per ounce over this period are expected to average $301 as byproduct revenues decline, largely due to lower zinc grades at depth.

LaRonde’s total cash costs per ounce were $103 on payable gold production of 203,494 ounces, placing it among the lowest cash cost gold mines in the industry. This compares to total cash costs per ounce of $106 on gold production of 216,208 ounces in 2008, as lower gold production was more than offset by stronger byproduct metals prices.

Good cost control continued to be a hallmark of LaRonde. Minesite costs per tonne were approximately C$72, roughly 7% higher than in 2008 due to cost pressures in the industry for inputs such as labour and chemical reagents, but in line with expectations.

In 2010, gold production at LaRonde is expected to decrease to approximately 180,000 ounces as gold grades decline until late 2011 when the deeper, richer ore of the LaRonde extension is accessed. From 2011 to 2014, annual gold production of approximately 248,000 ounces is expected, reflecting the higher gold grades. Total cash costs per ounce over this period are expected to average $301 as byproduct revenues decline, largely due to lower zinc grades at depth.

LaRONDE 2009 PRODUCTION

- 203,494 ounces of gold

- 3.9 million ounces of silver

- 56.2 tonnes of zinc

- 6.7 tonnes of copper

The Goldex mine achieved commercial production in 2008. It consistently operated at, or exceeded, design rates throughout 2009, processing an average of 7,164 tonnes per day compared to a design rate of 6,900 tonnes per day.

Payable gold production of 148,849 ounces at total cash costs of $366 per ounce was below expectation because of a decision to mine lower grade ore from the eastern and central mining blocks for part of the year to allow the preparations for a large blast in the higher-grade western block to take place in early 2010. By year-end, normal mining sequencing had resumed and grades were back to reserve estimates.

Cost control was very good at Goldex, with minesite costs per tonne of C$23. We believe that Goldex is one of the lowest-cost hard rock underground mines in the world.

At the current mining and blasting rate, it is expected that the Goldex orebody will be totally blasted approximately 1.5 years ahead of schedule, reducing costs over the balance of the mine life.

In 2010, gold production is forecast to be approximately 164,000 ounces, increasing to an average of 169,000 ounces, annually, from 2011 to 2014. Over this period, minesite costs per tonne are expected to average C$22 and total cash costs per ounce are expected to average $328.

Payable gold production of 148,849 ounces at total cash costs of $366 per ounce was below expectation because of a decision to mine lower grade ore from the eastern and central mining blocks for part of the year to allow the preparations for a large blast in the higher-grade western block to take place in early 2010. By year-end, normal mining sequencing had resumed and grades were back to reserve estimates.

Cost control was very good at Goldex, with minesite costs per tonne of C$23. We believe that Goldex is one of the lowest-cost hard rock underground mines in the world.

At the current mining and blasting rate, it is expected that the Goldex orebody will be totally blasted approximately 1.5 years ahead of schedule, reducing costs over the balance of the mine life.

In 2010, gold production is forecast to be approximately 164,000 ounces, increasing to an average of 169,000 ounces, annually, from 2011 to 2014. Over this period, minesite costs per tonne are expected to average C$22 and total cash costs per ounce are expected to average $328.

Goldex 2009 highlights

- Produced 148,849 ounces of gold

- Processed 7,164 tonnes per day

- Blasting 1.5 years ahead of schedule

The Lapa mine achieved commercial production on May 1, 2009. Production from the mine improved throughout the year, achieving the design rate of 1,500 tonnes per day by the fourth quarter.

Lower than expected payable gold production of 52,602 ounces and higher than expected total cash costs per ounce of $751 were largely the result of higher than expected ore dilution of the mining blocks and mine sequencing. Minesite costs per tonne were C$140. Costs are expected to decline significantly as the drilling, blasting, excavation and filling cycles are optimized for the orebody.

Gold production is expected to be approximately 116,000 ounces in 2010 and 118,000 ounces, annually, from 2011 to 2014. Total cash costs per ounce are expected to average $519 from 2011 to 2014, with minesite costs per tonne averaging C$123.

Lower than expected payable gold production of 52,602 ounces and higher than expected total cash costs per ounce of $751 were largely the result of higher than expected ore dilution of the mining blocks and mine sequencing. Minesite costs per tonne were C$140. Costs are expected to decline significantly as the drilling, blasting, excavation and filling cycles are optimized for the orebody.

Gold production is expected to be approximately 116,000 ounces in 2010 and 118,000 ounces, annually, from 2011 to 2014. Total cash costs per ounce are expected to average $519 from 2011 to 2014, with minesite costs per tonne averaging C$123.

About Lapa

- AEM’s smallest but highest-grade mine

- Eleven kilometres east of LaRonde

- Ore processed in a dedicated facility at LaRonde

- Anticipated seven-year mine life

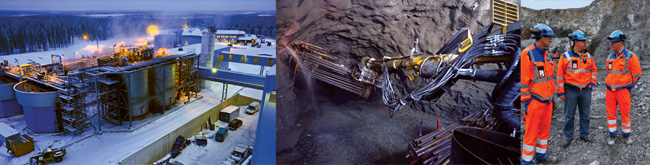

With gold first poured at the Kittila mine in January, production increased over the course of 2009 as recoveries improved. We anticipate operating near design rates throughout 2010.

Reflecting the optimization process, the Kittila mill processed an average of 2,728 tonnes per day in the fourth quarter of 2009, and achieved in excess of 3,500 tonnes per day in December, compared to a design rate of 3,000 tonnes per day.

Gold production of 71,838 ounces was lower than expected due to low recovery rates for the early part of the year. Higher than expected minesite costs of €54 were a reflection of the low tonnage milled, as were total cash costs per ounce of $668.

The Kittila mine is one of the largest known gold deposits in Europe. While the ore is initially being sourced from open pits, underground mining will begin in 2010. In 2009, underground development progressed in several areas and the first stope was extracted in January 2010.

In 2010, Kittila gold production is expected to be approximately 147,000 ounces. From 2011 to 2014, we are forecasting average annual gold production of more than 150,000 ounces at total cash costs per ounce of $520, and minesite costs per tonne of €53.

Reflecting the optimization process, the Kittila mill processed an average of 2,728 tonnes per day in the fourth quarter of 2009, and achieved in excess of 3,500 tonnes per day in December, compared to a design rate of 3,000 tonnes per day.

Gold production of 71,838 ounces was lower than expected due to low recovery rates for the early part of the year. Higher than expected minesite costs of €54 were a reflection of the low tonnage milled, as were total cash costs per ounce of $668.

The Kittila mine is one of the largest known gold deposits in Europe. While the ore is initially being sourced from open pits, underground mining will begin in 2010. In 2009, underground development progressed in several areas and the first stope was extracted in January 2010.

In 2010, Kittila gold production is expected to be approximately 147,000 ounces. From 2011 to 2014, we are forecasting average annual gold production of more than 150,000 ounces at total cash costs per ounce of $520, and minesite costs per tonne of €53.

Kittila PRODUCTION

- Open pit mining expected to last five years

- Underground mining began in 2010

- Processing plant includes AEM’s only autoclave

- Study under way to double annual gold production

By year-end, the Pinos Altos mine in Mexico was pouring gold from both its heap leach and milling operations. In 2009, payable production was 16,189 ounces of gold. Commercial production was 9,565 ounces at total cash costs per ounce of $596 and minesite costs per tonne of $28. The mine declared commercial production as of November 1, 2009.

While ramp-up at Pinos Altos was slower than expected due to issues encountered in the commissioning of the dry tailings pressure filters, the mill was operating at approximately 75% of design capacity by year-end. Ramp-up to full production levels will continue in 2010 and new filter capacity has been ordered.

Underground mining and the first stope extraction at Pinos Altos are scheduled to begin in the second quarter of 2010.

In 2010, gold production is expected to be approximately 151,000 ounces. From 2011 to 2014, annual gold production is expected to average more than 200,000 ounces with total cash costs per ounce averaging $263.

While ramp-up at Pinos Altos was slower than expected due to issues encountered in the commissioning of the dry tailings pressure filters, the mill was operating at approximately 75% of design capacity by year-end. Ramp-up to full production levels will continue in 2010 and new filter capacity has been ordered.

Underground mining and the first stope extraction at Pinos Altos are scheduled to begin in the second quarter of 2010.

In 2010, gold production is expected to be approximately 151,000 ounces. From 2011 to 2014, annual gold production is expected to average more than 200,000 ounces with total cash costs per ounce averaging $263.

Mining at Pinos Altos

- Series of open pits

- Underground mining to start in 2010

- Construction under way of an open pit heap leach operation at Creston Mascota

- Potential to develop several other satellite deposits

- Ebe Scherkus, President and COO, holding first gold bar poured at Meadowbank in 2010