In 2009, Agnico-Eagle Mines Limited neared the end of a major mine-building phase. By year-end, the Company had five mines operating in Canada, Finland and Mexico. The sixth mine, in northern Canada, began gold production in early 2010.

|

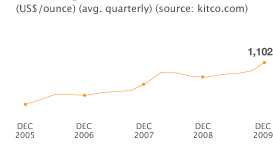

London gold PM fix

|

Declared annual

dividend (per common share)

In 2009, AEM declared its 28th consecutive annual cash dividend, payable in March 2010 at $0.18 per common share. |

|||||||||||||||||||||

2009 highlights

| > | Commercial production achieved at Lapa, Kittila and Pinos Altos. | > | Gold resources rose approximately 28% over 2008 level. |

| > | Record annual gold production of 492,972 ounces. | > | Low total cash costs per ounce of gold of $347, placing the Company in |

| > | Record proven and probable gold reserves of 18.4 million ounces. | the lowest quartile of cash costs in the industry. |

Key performance drivers

| Driver | 2009 performance | ||

| Spot price of gold | Gold prices continued their upward march as Agnico-Eagle realized a 16% increase in gold prices to $1,024 per ounce. | ||

| Production volumes | Record 492,972 ounces of payable gold production, largely due to additional production at the Goldex, Lapa, Kittila and Pinos Altos mines. | ||

| Production costs |

|

||

| C$/US$ exchange rate |

The Canadian dollar strengthened considerably by 16%. As many of the Company’s operating costs are denominated in Canadian dollars, this partly offset the benefit of higher byproduct revenues during the year. |

Total cash costs per ounce and minesite costs per tonne are non-GAAP measures. Reconciliations are included in the Form 20-F.