|

|

|

|

| |

|

|

| |

|

|

| |

LaRONDE |

|

| |

|

|

| |

|

| > | Proven and probable gold reserves of 5.0 million ounces |

| > | Estimated life of mine gold production averaging 340,000 ounces per year |

| > |

Life of mine total cash costs expected to average $150 per ounce |

| > |

$55 million invested in extension project to year-end 2007, estimated $170 million more to completion in 2012

|

|

|

|

|

|

|

|

|

LaRonde Production Summary

In 2007, the LaRonde mill processed 7,325 tonnes of ore per day, approximately the same level as in the past four years.

Payable gold production of 230,992 ounces was 6% lower than in 2006. In order to capitalize on historically high zinc prices, we mined additional tonnes of low-grade zinc ore. As a result, gold, silver and zinc production declined in 2007. However, this decision enables us to maximize the value of the orebody and extend the upper mine life by two years. This lower-grade zinc ore was not included in the original mining plan. Silver production in 2007 was 4.9 million ounces compared to 5.0 million ounces in 2006, and zinc production declined to 71,577 tonnes from 82,183 tonnes in the previous year. Copper production rose to 7,482 tonnes, from 7,289 tonnes in 2006.

Strong cost control performance continued throughout 2007. Minesite costs per tonne were approximately C$66, only 6% higher than in 2006, despite accelerated underground development and industry-wide cost escalation.

Net of byproduct revenues, LaRonde’s total cash costs per ounce of gold produced remained very low by industry standards, at minus $365 for the year, from minus $690 in 2006 and $43 in 2005. This change was primarily the result of variable byproduct revenue.

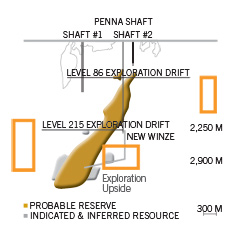

The LaRonde extension project will lengthen the life of the LaRonde complex by at least eight years, to 2021. It will enable us to reach the deeper ore at our current operation which is not accessible by the existing Penna Shaft. Construction commenced in 2006, and work continued on underground infrastructure construction and detailed engineering throughout 2007. Shaft sinking for the new internal shaft has begun, led by the same crews that successfully developed Lapa and Goldex.

|

|

|

|

|

|

|

|

$3 million allocated to

exploration in 2008

Focused on the massive sulphide structure west of the orebody

Resuming drilling on the

El Coco property to the east

|

|

| |

|

|

|

|

|

|